Market Intelligence

Commercially available market research and intelligence tools do not present the full picture. Navigating an increasingly competitive environment requires a bespoke approach.

At PGC, our unique process wins opportunities. Our industry and agency experts combine primary source intelligence and an intimate understanding of federal agencies’ mission requirements with analysis of budgets, plans, and spending to achieve superior insights at every level of the business development lifecycle. We produce a thorough and accurate assessment of the federal market, agencies, programs, and competitors to identify opportunities that suit each client precisely.

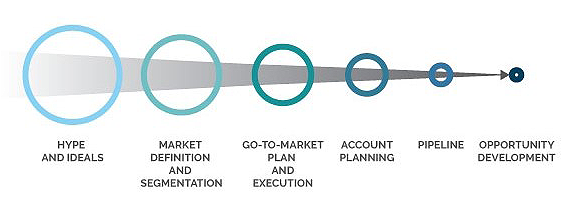

We reduce hype to what’s possible. From Strategy to Pipeline and Capture Plans.

Unparalleled Agency Expertise

We have experts with an average of 32 years of experience who provide agency knowledge and technology depth across the DoD, ID, Federal Civilian, and Health and Life Sciences markets.

Gain superior intelligence for better decisions. Our team of subject matter experts includes former government agency and industry leaders who excel at characterizing the context and directions for spending with smart perspectives delivered in:

- Acquisition Targeting Strategy

- Executive Consulting & Mentoring

- Executive SMEs

- Financial Assessment

- Growth Goal Setting

- Market Entry Strategy

- Organizational Assessment, Modeling & Transformation

- Service & Solution Offerings

- Small Business Evolution & Graduation

- Strategic Hiring Strategy

- Strategic Planning

Agency Insights

Discover deeper agency insights, including spending patterns, strategic priorities, and

goals and directions with:

- Agency Drilldown Insights to Form Account Strategies

- Comprehensive Analysis of Federal Landscapes for Procurements

- Key Decision Makers & Program Trends

Opportunity Intelligence

Gain detailed knowledge of specific deals through primary sources and insightful SMEs

with agency, technology, and deal expertise.

- Intelligence to Accelerate Capture Strategies

- Teaming Strategies

- Incumbent Program Research

Market Assessment

Our teams of Agency, Technology, and Business Development SMEs learn the client’s

portfolio and match their current needs to the latest demands in federal agencies. We

look for opportunities based on the market size, addressability, and agency channels for

purchase.

Go to Market Plan

Agency and Business Development SMEs define the specific strategies, resources,

partners, contract vehicles, and projects the client needs to develop opportunities and

land contracts.

Sector Landscape

Our approach combines our agency SMEs – a team with customer intimacy and trusted

relationships – with market data analysis. Clients gain intelligence on demand, insights

on the directions of agency requirements, and discovery of unmet needs across the

federal government.

Agency Drilldown

We deliver the information and insights needed to jumpstart an account plan. Agency

SMEs document the organizations, leadership, authorization, appropriations, current

programs, and upcoming opportunities. We also identify decision makers and influencers. This process anticipates agencies’ upcoming needs, the acquisition path, likely competitors, and candidate partners.

Smart Pipeline

A Business Development SME develops a non-qualified pipeline of opportunities. Then

our Agency SMEs prioritize opportunities based on the probability of competition and

award as well as agency’s preferences for competitors or solutions.

Agency SMEs help prepare the client for consulting with agencies about opportunities.

We jumpstart the process by providing intelligence that might otherwise take years to

learn. This ensures complete situational awareness –– the client engages correctly and

immediately delivers value to the agency — essentially a Gate 2 briefing.

GovCon Bids Differentiators

- Proven Proprietary Models – Our Allocation Model and Bid Evaluation Tool optimize capture investment and sharpen deal focus for higher win rates.

- Strategic BD Incentives – Custom-built models align business development compensation with growth and success.

- Agency & Market Expertise – With decades of experience across 40+ federal agencies, our SMEs provide unparalleled pipeline insights and deal intelligence.

- End-to-End BD Support – We engage across the entire business development lifecycle, ensuring seamless execution with no gaps in critical deals.

- Early-Stage Deal Shaping – Our proactive approach positions you ahead of the competition, influencing opportunities before they hit the RFP stage.